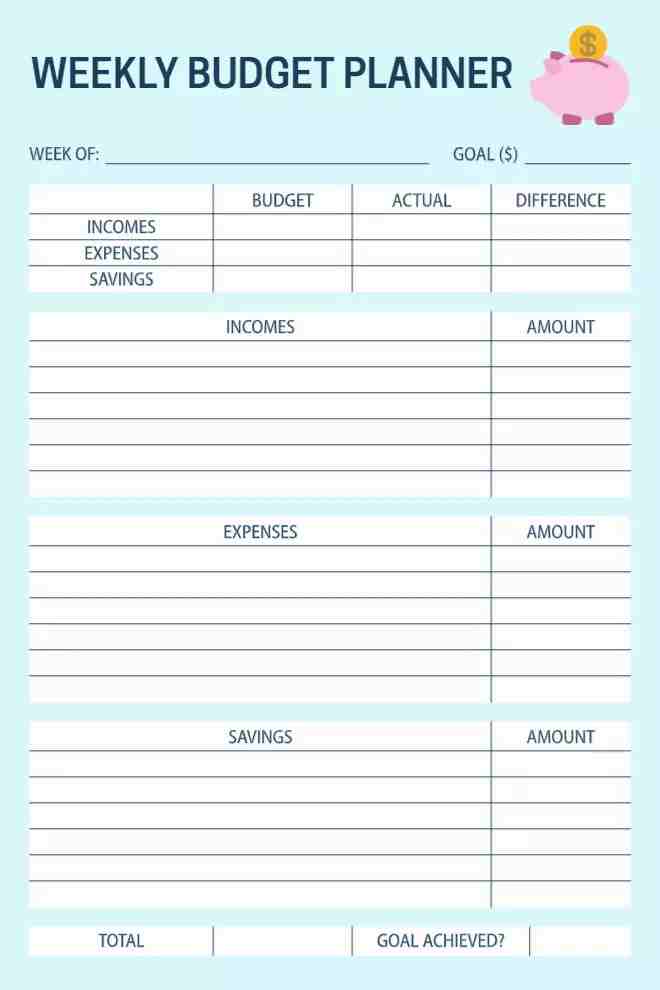

Take control of your finances with a budget planner template that’s simple, flexible, and designed for real household needs. Whether you’re managing daily expenses or planning ahead for your family’s needs, this weekly budget planner template offers a clear, grid-based layout to help you track income, monitor spending, and set achievable goals.

Alongside budgeting, managing your time is key. The weekly schedule maker by Planwiz helps you organize tasks clearly and efficiently. Paired with the mom planner template, it keeps your week and your finances on track.

The grid-based weekly budget planner template offers a systematic approach to budgeting, with separate areas dedicated to income and expenses. Its structured design enhances clarity, using clean lines and straightforward fonts. This practical format ensures users can efficiently manage their finances, making budgeting both simple and organized.

What Design Features Stand Out in Grid-Based Weekly Budget Planner Template?

The design of a grid-based weekly budget planner template plays a crucial role in making budgeting an effortless process. Several features enhance the usability and aesthetics of the planner:

- Structured Grid Layout: The well-organized columns separate budget categories, making income and expense tracking intuitive.

- Clear Typography: Simple, readable fonts ensure information is easy to scan and update.

- Soft Color Accents: Subtle color usage prevents visual clutter while maintaining an engaging look.

- Well-Defined Sections: Dedicated spaces for budgeted and actual amounts help in financial comparison.

- Minimalistic Design: The clean, distraction-free layout promotes focus and efficiency.

A well-designed budgeting template isn’t just about structure; it actively improves financial habits. By breaking expenses into clear categories, users can quickly spot spending patterns, identify unnecessary costs, and adjust accordingly. The visual clarity reduces mental load, making financial tracking less intimidating.

Step-by-Step Guide to Mastering Your Finances with the Weekly Budget Planner

The Weekly Budget Planner template is a practical resource to help you take control of your finances, one week at a time. Whether you’re looking for a no-cost way to track personal spending or need a clear layout to organize your family budget template, this free budget planner provides a simple and effective structure to keep your finances in check.

Ideal for individuals, students, or households, this planner can support your financial goals with clarity and ease. In this guide, we’ll walk you through how to use the worksheet, highlight the benefits of weekly budgeting, and share tips to help you stay consistent and successful. Let’s get started!

Step 1: Set Up Your Week and Define Your Savings Goal

The first step to using this budgeting tool is setting the stage for your financial week.

- Fill in the Week: At the top, you’ll see a field labeled “Week of:”. Enter the start date of the week you’re planning for. For example, if you’re starting on a Monday, you might write “Week of: May 19, 2025.” This helps you stay organized and track your progress over time.

- Set a Savings Goal: Next to “Week of,” there’s a “Goal ($)” field. Here, write down how much you aim to save by the end of the week. For instance, if you want to save $75 for a new pair of shoes or to build your emergency fund, enter $75. This goal acts as your financial North Star, guiding your spending and saving decisions.

Why It Matters: Starting with a clear week and goal gives you a sense of purpose. It also helps you prioritize your spending—knowing you want to save $75 might encourage you to skip that extra coffee run. This feature makes the tool ideal for goal-oriented individuals.

Step 2: List and Budget Your Incomes

Understanding your income is the foundation of any budget, and this free budget planner makes it easy with a dedicated “Incomes” section.

- Identify Income Sources: In the “Incomes” section, list all the money you expect to receive during the week. This could include your salary, freelance payments, side gig earnings, or even small cash inflows like a refund. For example, you might list “Salary,” “Freelance Project,” and “Gift from Family.” This makes the plan versatile for both personal and family budget template needs.

- Set Budgeted Amounts: In the “Budget” column, write down how much you expect to receive from each source. If your weekly paycheck is $600 and you’re expecting $100 from a freelance gig, enter those amounts accordingly.

- Track Actual Income: At the end of the week, fill in the “Actual” column with the real amounts you received. Maybe that freelance client paid $120 instead of $100—record that here.

- Calculate the Difference: In the “Difference” column, subtract the budgeted amount from the actual amount (Actual – Budget). A positive difference (e.g., $20 in the freelance example) means you earned more than expected, while a negative difference indicates a shortfall.

Example:

- Income: Salary (Budget: $600, Actual: $600, Difference: $0)

- Income: Freelance Project (Budget: $100, Actual: $120, Difference: $20)

Step 3: Plan and Monitor Your Expenses

The “Expenses” section is where you’ll allocate your money and keep your spending in check, making this a practical tool for a household budgeting template.

- Categorize Your Expenses: List all your expected expenses for the week in the “Expenses” section. Common categories include groceries, rent (if paid weekly), transportation, utilities, entertainment, and dining out. Be as specific as possible—breaking down broad categories like “miscellaneous” into smaller ones (e.g., “coffee,” “subscriptions”) helps you track spending more accurately.

- Allocate Budgeted Amounts: In the “Budget” column, assign an amount to each category based on your total income and savings goal. For example, if your total income is $720 and your savings goal is $75, you have $645 left for expenses. You might budget $150 for groceries, $60 for transportation, $50 for entertainment, and so on.

- Record Actual Spending: Throughout the week, track your spending and fill in the “Actual” column at the end of the week. If you spent $160 on groceries instead of $150, note that here.

- Calculate the Difference: For each category, subtract the budgeted amount from the actual amount. A negative difference (e.g., -$10 for groceries) means you overspent, while a positive difference (e.g., $10 for transportation) means you saved.

Example:

- Expense: Groceries (Budget: $150, Actual: $160, Difference: -$10)

- Expense: Transportation (Budget: $60, Actual: $50, Difference: $10)

- Expense: Entertainment (Budget: $50, Actual: $30, Difference: $20)

Step 4: Track and Grow Your Savings

Saving money is a key part of financial health, and the “Savings” section helps you prioritize this goal with this weekly budget template.

- Define Savings Categories: In the “Savings” section, list where you want to direct your savings. This could be an emergency fund, a vacation fund, a down payment for a car, or even a “treat yourself” fund. For example, you might list “Emergency Fund” and “Vacation Fund.”

- Set Savings Targets: In the “Budget” column, note how much you plan to save in each category. If your total savings goal is $75, you might allocate $50 to your emergency fund and $25 to your vacation fund.

- Record Actual Savings: At the end of the week, fill in the “Actual” column with the amounts you actually saved. If you managed to save $60 for your emergency fund because you spent less on entertainment, record that here.

- Calculate the Difference: As with income and expenses, calculate the difference between your budgeted and actual savings. A positive difference means you saved more than planned—great job!

Example:

- Savings: Emergency Fund (Budget: $50, Actual: $60, Difference: $10)

- Savings: Vacation Fund (Budget: $25, Actual: $20, Difference: -$5)

Step 5: Calculate Totals and Evaluate Your Goal

The final step is to review your overall financial picture and assess your progress with this budgeting worksheet.

- Sum Up the Totals: In the “Total” row at the bottom, add up the amounts in the “Budget” and “Actual” columns for incomes, expenses, and savings. For example, if your budgeted expenses were $260 and your actual expenses were $240, write those totals here.

- Check Your Savings Goal: Compare your actual savings to the goal you set at the beginning of the week. If your goal was $75 and you saved $80, congratulations—you exceeded your target!

- Reflect on Your Progress: In the “Goal Achieved?” section, write “Yes” if you met or exceeded your savings goal, or “No” if you didn’t. If you didn’t meet your goal, think about what happened. Did unexpected expenses pop up? Did you overestimate your income? Use these insights to adjust your plan for the next week.

You can also use a goal planner template alongside your budget to set clearer financial intentions and track long-term progress more effectively.

Example Use Case:

| Category | Budget | Actual | Difference |

|---|---|---|---|

| Incomes | $700 | $720 | +$20 |

| Expenses | $260 | $240 | +$20 |

| Savings | $75 | $80 | +$5 |

| Source | Amount |

|---|---|

| Salary | $600 |

| Freelance Project | $120 |

| Category | Amount |

|---|---|

| Groceries | $160 |

| Transportation | $50 |

| Entertainment | $30 |

| Fund | Amount |

|---|---|

| Emergency Fund | $60 |

| Vacation Fund | $20 |

Why It Matters: This step gives you a clear picture of your financial health for the week. Seeing where you succeeded or fell short helps you make smarter decisions moving forward, making this a reliable tool for long-term planning.

Why Is White Space Key in this Grid-Based Weekly Budget Planner Template?

White space, or negative space, plays a crucial role in the design of a grid-based weekly budget planner template. It enhances readability, keeps the design organized, and helps users stay focused on essential details. A well-implemented white space layout results in a more efficient and visually appealing budgeting experience.

Enhances Readability

By providing adequate spacing between sections, white space prevents text from appearing cramped or cluttered. This improves the readability of financial data, allowing users to easily scan and understand the content. It eliminates distractions, ensuring that the information is clear and accessible, which is especially important when managing complex financial details like expenses or savings goals.

Boosts Focus

White space strategically placed around key sections of the grid helps users focus on what matters most, such as income, expenses, and savings. The spacing creates a natural flow, drawing attention to critical figures. By reducing visual noise, users can quickly locate important information, make informed decisions, and keep their budgeting on track without distractions.

Improves Aesthetic Appeal

A clean design with ample white space makes the planner visually appealing. The negative space contributes to a minimalist style that feels modern and professional. This simple yet elegant approach enhances the overall user experience, providing a calm and inviting atmosphere that motivates users to engage with the planner and stick to their budgeting goals.

Supports Better Organization

Using white space effectively in a grid-based planner helps separate various financial categories. This creates a well-organized structure, allowing users to quickly identify and compare different aspects of their budget. Implementing effective planner organization ideas for financial tracking ensures clear distinctions between sections like income, expenses, and savings, making updates and adjustments effortless and eliminating confusion.

Is the Grid-Based Weekly Budget Planner Template More User-Friendly?

The grid-based Weekly Budget Planner template is designed for maximum user-friendliness. Its simple layout ensures easy data entry, allowing users to quickly input their planned and actual amounts. This minimizes errors and confusion. The grid structure provides clarity, making the financial process simple and effective for users at all skill levels.

This template offers a quick comparison between planned expenses and actual spending. The clear grid format makes it easy to assess whether you’re staying on budget. Users can instantly spot discrepancies between projections and reality, facilitating quick adjustments. The planner promotes financial awareness by allowing users to track and review spending in real time.

The grid-based planner is versatile and adaptable for multiple uses. Whether for personal, household, or business finances, the template fits all needs. It can also serve as a weekly planner template for weekly challenges that help users set and track financial goals or spending limits. Use it digitally or in print—its structured design keeps finances organized.

Benefits of Weekly Budgeting with This Planner Template

Weekly budgeting has distinct advantages over monthly budgeting, especially for those who need more control over their cash flow. Here’s why this budgeting worksheet stands out:

- Frequent Check-Ins Prevent Overspending: Reviewing your budget every week lets you spot issues early. For example, if you overspend on groceries by Wednesday, you can cut back on entertainment for the rest of the week, avoiding a month-end crunch. This makes it a practical choice for families managing weekly expenses.

- Ideal for Irregular Income: If you’re a freelancer, gig worker, or have variable income, weekly budgeting helps you allocate funds as they come in. The “Difference” column ensures you’re always aware of how your income fluctuates, making it a great option for those seeking a digital budgeting solution that adapts to their needs.

- Real-Time Feedback Keeps You Disciplined: The “Actual” and “Difference” columns act like a financial report card, showing you exactly where you’re on track or off course. This immediate feedback helps you stay accountable, a key feature of any effective tracker.

- Goal-Oriented Design Motivates You: The savings goal at the top keeps you focused, and the “Goal Achieved?” section adds a motivational element to celebrate your progress. Whether you’re saving for a vacation or building an emergency fund, this feature makes it a top pick for goal-driven individuals.

- Flexibility for All Households: Unlike monthly budgeting, which can feel overwhelming for those with tight cash flow, this weekly approach offers more control and flexibility. It’s ideal for students, young professionals, or families managing shared expenses.

Why Weekly Over Monthly? Monthly budgeting often requires you to plan far ahead, which can be tricky if your expenses or income vary. Weekly budgeting, on the other hand, breaks your finances into manageable chunks, allowing you to adjust as you go. This tool leverages that flexibility, making it easier to stay on track.

Tips for Sticking to Your Weekly Budget

Budgeting can be challenging, but these tips will help you succeed with this free budget planner:

- Be Realistic with Your Budget: Set achievable budgets for expenses based on past spending patterns. If you typically spend $120 on groceries, don’t budget $80—plan for $120 and aim to reduce gradually. This approach ensures the tool works for your real-life needs.

- Track Daily to Stay on Top of Spending: Update the “Actual” column daily to avoid forgetting small expenses. Use a notes app or keep receipts to log spending as you go. This habit turns the worksheet into a powerful tracker for daily accountability.

- Plan for Irregular Costs: If you know a one-time expense (e.g., a doctor’s visit or a car repair) is coming, include it in your expense list to avoid surprises. This foresight makes it a reliable option for managing unexpected expenses.

- Review and Adjust Weekly: At the end of the week, analyze the “Difference” column. If you overspent in one area, reduce spending in another the next week. For example, if you went over on entertainment, cut back on dining out the following week.

- Celebrate Small Wins to Stay Motivated: If you achieve your savings goal, reward yourself with a small treat (within budget!) to stay motivated. For instance, if you saved $80 against a $75 goal, treat yourself to a $5 coffee. This positive reinforcement makes budgeting enjoyable.

Conclusion

A grid-based weekly budget planner template is a structured way to manage finances. With a structured layout, white space, and a user-friendly design, it simplifies budgeting while ensuring accuracy. A PlanWiz planner app helps track income, monitor expenses, and set savings goals. Start using one today to make budgeting a seamless weekly routine!

FAQs

It’s a structured tool with a grid layout that helps you plan and track your weekly budget, including income, expenses, and savings, to manage your finances effectively.

You can track your weekly income, expenses (like groceries or bills), savings contributions, and the difference between budgeted and actual amounts.

The money tracker allows you to monitor your spending in real-time, categorize expenses, and see how much you have left to spend each week, helping you avoid overspending.

Yes, you can set a weekly savings goal in the template and track your progress by comparing your actual savings to your target amount.

Yes, most templates allow you to rename or add categories in the grid to match your specific expenses, like adding “kids’ activities” or “subscriptions.