Controlling your supermarket budget should not be a daunting task. This is because a shopping budget management planner offers a completely free experience to manage your spending by assisting you in listing the products, monitoring their quantities, and calculating their costs before actual purchase, whether it is for food products, clothing, household items, or gifting solutions. In this way, you can make informed choices even when budget limitations arise.

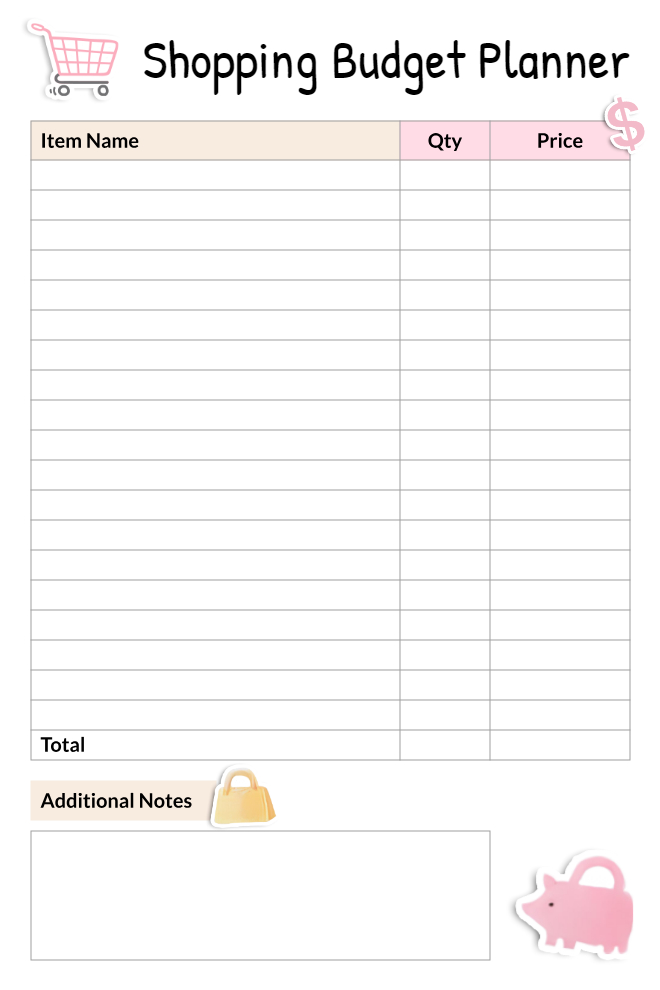

Planwiz‘s free template is a breeze to navigate with its columns for item names, quantities, and prices, as well as a notes section that is specifically for recording coupons, sales, and priorities. You can get the printable PDF if you want to use it in the store or the editable digital version if you want to personalize it on your phone or computer. Why not start shopping more intelligently right away and see your savings increase with each shopping?

What is a Shopping Budget Management Planner?

A Shopping Budget Management Planner is a type of budgeting worksheet where you are able to organize, estimate, or monitor your expenses before and at the point of purchase. Unlike the traditional shopping list where you simply note down the things you are going to buy, a Shopping Budget Management Plan takes into account the values of the quantities you are purchasing in its columns, which gives you a complete perspective of the money you are spending at the current point in time, be it clothing or household essentials.

The primary purpose is preventing overspending through pre-trip planning and real-time cost awareness. When you write down items and their estimated costs beforehand, you create financial accountability that reduces impulse purchases by 30-40%. The planner’s total calculation feature lets you see immediately when you’re approaching your budget limit, allowing you to make trade-off decisions-choosing generic over name brands, removing lower-priority items, or postponing non-essential purchases.

How to Create a Shopping Budget Management Planner?

Creating a shopping budget doesn’t have to be complicated. Follow these five simple steps to take control of your spending and start saving money on every shopping trip.

Step 1: Determine How Much You Can Spend

Look at your statements from the past 2-3 months to figure out what exactly is your shopping expenditure. Calculate the average by adding all your shopping expenditures such as groceries, clothes, household items, and consumer products.

Set aside 10-15% of your monthly earnings for groceries and essential purchasing, and 3-5% for other purchases. In the event your expenditures are above the percentages indicated above, adjustments must be made utilizing the Shopping Budget Management Planner. To effectively manage your monthly finances otherwise, a budget planner templates may be utilized for the various expenditures of your whole household.

Step 2: Divide Your Budget Into Spending Categories

Split your overall shopping budget into categories, which should include groceries, home supplies, personal items, wardrobe, and miscellaneous. Set dollar values on these categories that are practical and manageable.

Example: Groceries ($500), Household ($80), Personal Care ($60), Clothing ($100). Set budget boundaries for each of the above categories in your planner to not overspend in one category while underspending in the other.

Step 3: Prioritize Needs Over Wants

Prioritize identifying absolute requirements before every shopping trip: food essentials, medicines, toiletries, and immediate replacements for existing items. The budget for these requirements should not exceed 70-80% of spending.

The beginners should utilize the budget planner for purchasing for categorizing “needs” from “wants” based on the priority level. When the budget is limited, they will be aware of the items for prioritized purchasing.

Step 4: Find Sales and Compare Prices

Check weekly advertisements in the supermarket for sales of items you plan to buy. This will help you save money by 15-25% and make your budget more efficient. Record sale merchandise in your planner using the names of the stores and prices.

Buy non-perishable items when they are discounted, but only buy what you can consume before the expiration dates. Combine a grocery budget with meal planner templates to help you come up with a week’s menu using products at a discounted price.

Step 5: Monitor Your Spending and Make Adjustments

Every week, you’ll need to record how much you really spent when you went shopping, comparing this to how you wanted to spend. You’ll be able to see where you went over or under, making adjustments accordingly for the following week.

Look at your planners every week to monitor the rising costs. Making corrections every week will save your month-end budget disasters and allow you to develop good shopping habits. Schedule your shopping routine with the monthly schedule planner templates to ensure your shopping schedule is on the same schedule as your payday schedule and billing dates.

Frequently Asked Questions

A shopping budget management planner is a tracking tool that helps you list items before purchasing, estimate costs, and stay within spending limits. It prevents overspending by creating a visual record of what you plan to buy and how much it will cost.

Using this planner reduces impulse purchases by up to 40% because you commit to a list before entering the store. It works for groceries, clothing, household items, and any other shopping category where you need to control expenses.

Most people who use planners consistently save $100-200 per month by avoiding unplanned purchases. The simple act of writing down items creates accountability and helps you distinguish between needs and wants before spending money.

Begin by noting down all the items you need in the “Item Name” column, add their quantities, and start noting the approximate or actual price for each item in a similar manner, also in the “Actual Price” column for both LAN cables and USB cables, and so forth for all other items.

Furthermore, you need to add your running total while you are

Make sure to fill out your shopping budget management planner before leaving the house by scanning your pantry and closets for existing inventories. This is a good technique to eliminate buying things that were not really needed in advance.

Carry your organizers with you while shopping (either printed or on your mobile phone) and mark them as you put them into your shopping basket. Changes in price real-time as you get close to your budget limit and start deciding on your trades.

Absolutely, you can use this template for grocery, clothing, household, gifts, or any type of shopping with simple modifications based on the items you enter. I suggest multiple copies or files for each type of shopping pattern.

To organize the data of the groceries bought by a customer through shopping, the columns should be arranged by sections of the store (produce, dairy, frozen). To organize data of the groceries bought by a customer through online shopping, the columns should be added to include the name of the website and the cost of shipment.

Many families customize their shopping budget management planner by adding priority markers (must-have vs. optional) or store locations if they shop at multiple places. You can also add a “coupon” column to track discounts and see your actual savings each trip.

It is important to update your planning calendar prior to each shopping trip, whether on a weekly basis for groceries or a monthly basis for household items. This will ensure that the prices and inventory levels that you are working with are accurate.

You can go through the completed planners each month to determine how you have been spending, as well as identify areas that you have overspent. The review will enable you to adjust how you have allocated funds as a way to save costs in certain areas.

Keep your planning book filled throughout the week by adding things as you use them up or notice you need more of them. Not only will you remember things that you need, you’ll also avoid unnecessary things you pick up because you forgot them the first time around.

For budgeting purposes, incorporate your budget planner with daily planner templates in order to note financial needs as they occur.

The Additional Notes section is to be used to track coupons, sales, expiry dates, store location, or personal preferences for particular brands. This feature is very handy to keep track of all important aspects that influence buying.

See if there are any sales or coupons available for each item so you can plan on buying those things first.

You can also create reminders for yourself, such as “check unit price” or “compare generic brand,” for certain items for which you’d like to consider a cheaper option.

Customers also use this part of the sheet to analyze price comparisons from multiple stores or from multiple market journeys. Writing down “Store A: $3.99, Store B: $4.49” ensures that the buyer remembers the stores with the lowest costs for the respective items.

You can understand your expenses by using a shopping budget management organizer for 2 to 3 months. This way, you’ll find out where most of your money goes for recurring purchases. After you have confirmed a pattern, you might look for cheaper options or check the prices of similar products to those of brand, name products.

Make firm decisions by, for example, cutting the grocery bill by 10 percent each month or reducing clothing expenses by $50. According to your planner, you will be able to implement these decisions by keeping track of your figures and, once you reach the budget, cutting out lower, priority items.

Introduce the 24, hour waiting rule for non, essential purchase decisions by writing them in your calendar and delaying the purchase until the following day. Waiting for a day before buying can save you an average amount of $50 to $100 each month by preventing impulsive buying.

Digital planners work best for online shopping and people who always have their phones available because you can access them anywhere and auto-calculate totals with formulas. They’re also easier to save and review past shopping trips for spending analysis.

Printable versions are ideal for in-store shopping where you prefer writing by hand and don’t want phone distractions. Many shoppers find physically crossing off items more satisfying and easier to reference quickly while navigating store aisles.

The best approach is using both-maintain a digital master shopping budget management planner for tracking and calculations, then print weekly or monthly copies to bring on actual shopping trips. This combination gives you calculation convenience and in-store usability.

Build in a buffer of 10-15% of the estimated total, to account for price increases, sales tax, and for other ‘necessities’ that come up unexpectedly. That will cushion the shock when the actual prices of what you buy exceed your estimate at checkout.

If it is far more expensive than expected, compare your running total immediately and make a decision to purchase it, use a cheaper alternative, or delete an item lower in priority. The decisions made at this time with your shopping budget planner will prevent over-investments.

Keep notes on actual prices compared to estimates for items you buy regularly, so over time planning gets closer to the reality. After a few shopping trips-3 to 4-your price estimates will closely fit the reality and would require less adjustment when you go shopping.

Absolutely-make one for the weekly outings (usually groceries and frozen items), and the other for the monthly outings (household items and toiletries). This will help you better manage your expenditures based on the type of purchase.

Use your weekly planner templates to organize shopping excursions around meal preparation and other domestic chores that you have scheduled for the week.

Weekly planners should pick up new items with shorter shelf lives, while monthly planners are better suited for non-perishables, household cleaning agents, or items for which purchases can be stockpiled when they are put on sale.

Others opt to use both by creating a master shopping budget planner with sections for both weekly and monthly shopping. Color coding or making use of different regions in the template helps in creating an organization for shopping done at different frequencies.

The most common mistake is shopping without completing your planner first, which leads to 20-40% more spending than intended. Never make a “quick trip” without at least a basic list and estimated total in your shopping budget planner.

Another major error is ignoring unit prices and assuming bigger packages always offer better value. Always calculate price-per-unit or price-per-serving to determine true savings, especially for bulk purchases that might expire before you use them.

Many people also fail to account for sales tax in their estimates, causing their actual total to exceed budget limits at checkout. Add 5-10% to your subtotal for taxes, and regularly update price estimates as inflation and store prices change throughout the year.

The use of a shopping budget planner ensures that you are aware of where your money goes every month by highlighting areas you can cut in order to use that money for savings and debt payment. Saving an extra $50 to $100 per month in shopping amounts to saving $600 to $1,200 per year.

Keep tracking these savings in an allocation towards certain goals with the help of goal planner templates.

The skill of planning a purchase prior to making it helps improve personal money management skills in general. Individuals who budget their purchase on a regular basis are 65% more likely to take care of their emergency savings and retirement savings because they are money-conscious.

Budgeting for shopping can also ensure that there is no lifestyle inflation with an improved income because one will be tracking all spending.

The planner is now your personal financial instrument that helps you accomplish large-scale plans for buying a home, traveling, or retiring early.