Stretched out with credit card debt with no way out? A credit card payment tracker will help make messes of monthly statements into a straightforward way of paying off debt by letting you see exactly where every dollar is going and exactly which payments bring you closer to being debt-free. The organizer makes paying off debt from a concept into something very real that can actually happen right before your eyes!

Whether you’re dealing with one card or several balances with different due dates and interest rates, having all your financial information right at your fingertips makes all the difference when it comes to your approach with your debt. Download this free printable tool offered by Planwiz, and start cataloguing your progress today. Seeing your balance dwindle with each entry makes all the difference when the finish line seems like a distant light.

What is a Credit Card Payment Tracker?

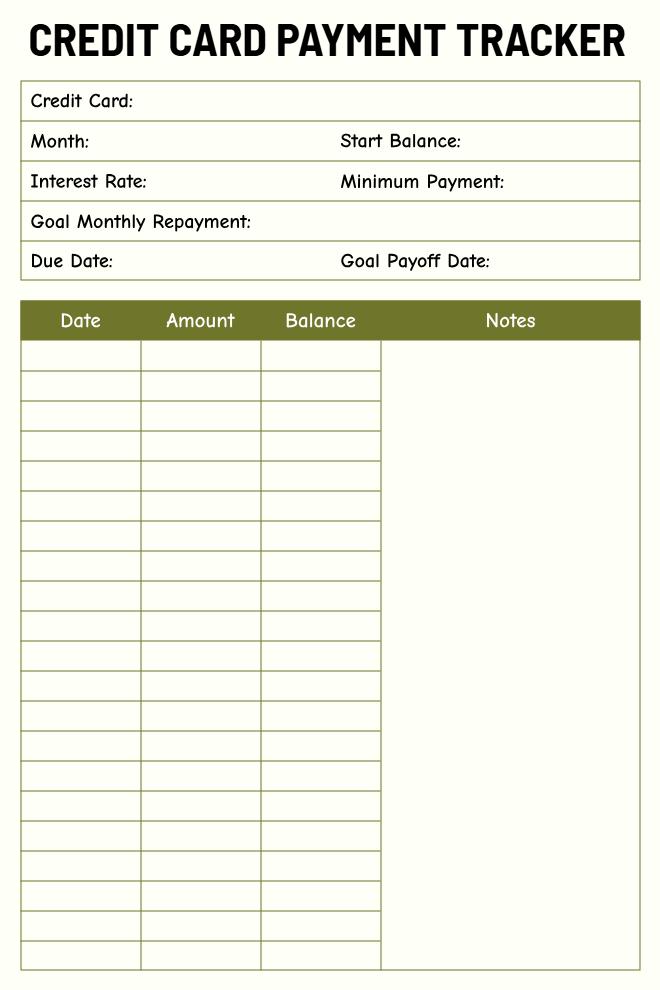

A credit card payment tracker is a structured financial document that consolidates all your debt information into one organized system, helping you visualize the path from your current balance to zero. Unlike mobile banking apps that only display snapshots of what you owe today, this tracker creates a historical record of every payment you make, showing exactly how your debt decreases over time and whether you’re meeting your repayment goals.

The tracker’s power lies in transforming invisible progress into visible wins through its simple column structure-date, payment amount, remaining balance, and notes. Whether you’re tackling $2,000 on one card or $20,000 across multiple accounts, this removes the guesswork from debt elimination by showing precisely where you started, where you are now, and how many payments remain before you’re completely debt-free. For comprehensive financial planning beyond debt tracking, explore budget planner templates to manage all aspects of your finances.

How to Use a Credit Card Payment Tracker?

Getting started with your tracker is straightforward and takes less than 10 minutes. Follow this quick setup process to begin monitoring your debt repayment journey effectively.

Quick Setup (5 Minutes)

Gather Your Credit Card Information

Please take out the latest copies of your credit card statements to write down the current balance, APR, minimum payment, and due date. If there is more than one, focus on the one sporting the highest balance or APR.

Fill in the Header Section

Fill in your credit card name, starting balance, annual percentage rate, and minimum monthly payment in the top fields. Set a goal monthly repayment amount that’s at least 2x your minimum payment-this accelerates payoff significantly.

Set Your Target Payoff Date

Enter your desired payoff date in the “Goal Payoff Date” field based on how aggressively you plan to pay down the balance. Be realistic but challenging-most people benefit from setting a 12-24 month target for moderate balances.

You can set the target repayment amount every month to be at least 2 times your minimum payment amount. This is an excellent idea when combined with your goal planner templates for checking overall goals.

Daily Tracking (2 Minutes Per Payment)

Log Every Payment Immediately

With every payment you make, you record the date and amount paid and calculate the amount you have left. You could record these every month-end, but you’d stay more motivated if the entries were recorded as soon as you pay, showing you’re off and on track every step of the way.

Use the Notes Column Strategically

Track why you’re making extra payments (bonus, tax refund, side hustle income) or note interest charges that appear on your statement. This column helps identify spending patterns and celebrates wins like “Paid off 50%!” or “Saved $200 in interest.”

Weekly & Monthly Reviews

✓ Weekly Check (5 minutes): Review your declining balance and confirm you’re on track to meet your goal payoff date

✓ Monthly Deep Dive (15 minutes): After your statement closes, verify tracked balance matches actual balance, record interest charges, and adjust your goal repayment if income changes

✓ Quarterly Strategy Session (30 minutes): Reassess your entire approach, celebrate major milestones, and update your payoff date if you’re ahead of schedule. Quarterly planner templates can help you organize these strategic review sessions alongside your debt tracking routine.

Frequently Asked Questions

A credit card payment tracker is an organization tool that will assist you in Debt Repayment by listing down the dates, value, and reducing balances all in one record.

The system will give you a visual display regarding your freedom from debts, contrary to different credit card statements or applications on your cell phones.

This tool will be critical in the case of several cards in your possession as well as in using strategies for paying off debt through a debt avalanche or a debt snowball strategy. The debt will then be transformed into a monthly task that will motivate you as you navigate through debt.

Credit card statements merely reflect your balance and transactions, while the payment tracker illustrates your payment process in weeks or months. Credit card statements cannot calculate how long you would take to pay off your balance or how your extra payment will work.

The tracker enables you to set targeted goals and track how you’re progressing towards achieving these goals while also being able to compare your cards side by side in order to optimize your debt repayment plan.

It’s the difference between knowing how much you’re owing and having a plan on how you can get rid of that debt.

People with credit card debt can surely benefit using a payment tracker, and these include students using their first-ever credit card, individuals with debt trying to consolidate it, as well as those trying to optimize their usage ratios. People trying to raise their credit scores can greatly benefit using a payment tracker.

The template is very helpful in situations where visual accountability is required in order to ensure continued motivation in repaying the debt over time.

The template is very helpful in situations where you may have had trouble understanding where your money is actually going because you have been overwhelmed by debt.

Begin this process by collecting your most recent credit card statements to bank important information about your current balances, rates of interest, minimum payment amounts, along with due dates.

Enter this information in the header section of your planner. Determine a realistic monthly payment amount above the minimum.

Start keeping your records of payments as soon as you have completed them by documenting the date, the actual funds you have

paid, and your new balance after each transaction. Check your records weekly to see how your balances are decreasing and monthly to change strategies accordingly based on developments in your financial conditions.

Alongside your records of your finances, use daily planner templates in order to monitor your spending behavior that influences your debt repayment process.

Make sure to update your tracker each time you make a payment so that the information about your balances is up to date. Ideally, update your tracker on a monthly basis after your statement is closed to record the interest charges that have been made on the credit card.

It helps you remain actively involved in your debt management process. Besides this, successful debtors also perform analysis on a quarterly basis. They review their debt management strategy, update their target for debt repayment, and achieve major milestones.

Absolutely. You can have different sheets in the tracker for each of your cards. You can then store these in a binder or electronic folder. Alternatively, you can have one tracker where you have color-coded rows or sections to denote different cards.

To handle multiple cards, include a summary page where the total amount owed on all accounts and the overall payoff timeframe are displayed.

The master page is helpful in executing a plan, for example, the debt avalanche plan (paying off the highest-interest cards first) and the snowball plan (paying off the cards with the smallest balances first).

Add features to visualize progress, for instance, a column to indicate the percentage of the original amount paid off by utilizing the tracker. Add encouraging messages at the time of achieving certain milestones, for example, 25%, 50%, or 75% of the amount paid off.

Some people attach photos of rewards they’ll enjoy when debt-free or use color-coding where rows turn green as balances approach zero. You can also track total interest saved by paying more than minimums, showing exactly how much money your extra efforts are keeping in your pocket.

Keep a daily journal templates to document your emotional journey and celebrate small wins throughout your debt-free path.”

Credit card name, Initial balance, APR, Minimum payment, Repayment goal, Payoff target date are essential fields required to be in the header. While basic, this provides you with a complete financial picture.

Your transaction log should have columns such as date of payment, amount paid, balance after the payment, and comments for extra payments. The number of rows should be adequate to facilitate the tracking of your repayment period, which should be between 12 to 24 months.

The most critical error is only paying minimum amounts while tracking, which can extend repayment to 15-30 years due to compound interest eating up most of each payment. Your tracker should motivate you to exceed minimums, not just document slow progress that barely impacts your principal balance.

Secondly, quitting the tracker after missing one payment or having a setback financially, when the value of maintaining consistency is most realized during such periods, is another major blunder.

Let not perfectionism prevent making progress, since missing a target for one month would mean correcting the details on the tracker accordingly.

Record each and every extra money payment made as a separate entry under the notes section to calculate how significantly such windfalls as tax refunds and bonuses can accelerate payments towards reaching any financial goal.

All such amounts should be directly applied to the principal amounts to see when the payoff date can be achieved.

Boost your monthly payoff goal by as little as $10 to $20 whenever you receive a pay increase or eliminate expenditures in your budgeting list.

Check your progress indicator quarterly to spot whether you are making more rapid progress than expected, allowing you to pay off your debts early in advance of your original payoff plan. Utilize monthly schedule planner templates to help you plan your debt repayment against other expenditures.

Absolutely, transition your tracker from debt elimination to spending monitoring by logging monthly charges and ensuring you pay the full statement balance each billing cycle. This prevents falling back into debt by maintaining awareness of your credit utilization and spending patterns.

With the use of your tracker, mark that you’re now using credit for rewards and convenience rather than for covering purchases that you cannot afford.

This way, you’ll develop financial discipline with time by monitoring the process and learn the signs in case the amount spent grows beyond your budget.